More Analyst Garbage

In light of the recent analyst reports from Bear Stearns and Raymond James, NYSE ArcaNews felt it appropriate to remind folks about the lousy track record that these wizards have when it comes to assessing how the market will value shares of NYX (or AX as the case was prior to 3/06).

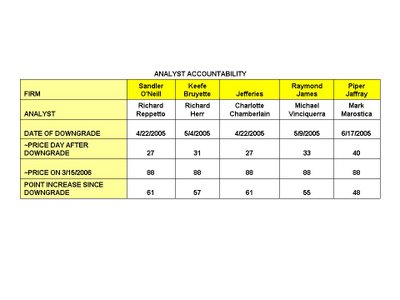

In light of the recent analyst reports from Bear Stearns and Raymond James, NYSE ArcaNews felt it appropriate to remind folks about the lousy track record that these wizards have when it comes to assessing how the market will value shares of NYX (or AX as the case was prior to 3/06).If you click the chart above (it'll enlarge and) you'll notice that many of the analysts that cover NYX have been consistantly wrong for quite some time.

Bearish Stearns

Many of these analysts have demonstrated that they don't know how to determine how the market will value shares of companies in NYX's competitive landscape. For example, Dan Goldberg, the author of yesterday's Bear(ish) Stearns report (incidentally, the NYSE and the SEC fined Bear $250 million recently for violating rules), piped up on May 6, 2004 and slapped the same rating on CME as he did yesterday on NYX. "Peer Perform" is the classification that Goldberg gave to both CME in '04 and NYX yesterday. On May 6, 2004, CME closed at $116.36. Imagine taking his research to heart and either selling CME short at those levels or simply selling CME or not buying it due to Goldberg's call.

As of this posting, CME is trading at $462/share! Talk about contrarian indications!

Raymond James

Not to be outdone, Michael Vinciquerra, the scribe of today's Ray Jay report, demonstrated his difficulty with forecasting a stock's performance during last summer. On July 7, 2005 Mr. Vinicquerra downgraded AMTD which closed that day at 14.05 (adjusted for dividend). Not even a year later, AMTD is trading at ~17/share.

Time and time again, analysts like most of the ones covering NYX, have gotten it wrong. It's incredible that the buy-side is still willing to pay for insight that a 3rd-grader could have. It's truly a wonder that these analysts have managed to stay relevant. Perhaps even more amazing is how Wall Street reacts to their nonsense.

Ultimately, facts prevail. At that point it becomes clear if analysts were right with their assessments. Fortunately, there's enough history, and an easily accessible record of bucket-headed calls (see finance.yahoo.com) to guide investors towards what authors/reports are worth reading -- and which authors/reports aren't worth wasting any time (or soft dollars) on.

0 Comments:

Post a Comment

<< Home