Yesterday, the Dallas Morning News ran a story that does a good job explaining why the traditional US stock exchanges are shiverring in their boots. To save you the trouble of registering, I've posted the article at the end of this entry. You can see the original story here:

Robert McCooey Jr., chief executive officer of the Griswold Co. and an NYSE broker is quoted and appears to be kicking and screaming. Here's one of his whines, "If all the orders are displayed all the time in one system, that's it. There is no ability to compete and no reason for an exchange."

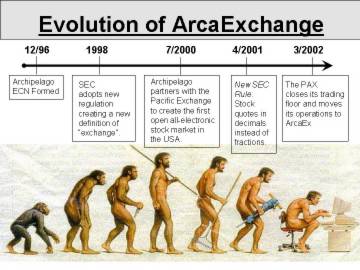

ArcaEx is incredibly well positioned for any such rule change. Wayne Gretzky attributes much his success to "playing where the puck is going. . .not where the puck is." We all know where the rules are headed, and it is clear that there is no other system as well positioned as AX for where the "puck" is headed.

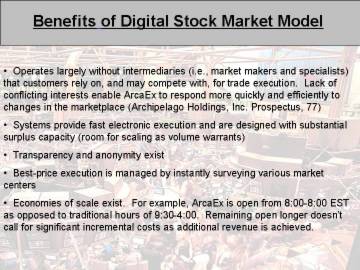

The Securities and Exchange Commission may soon unveil a new version of a proposal that, if adopted, would radically change the way stocks are traded.

The proposal, which staffers may present to the five SEC commissioners Dec. 15, would expand the so-called "trade-through" rule. The New York Stock Exchange adopted the trade-through rule in 1975 to create an orderly market structure out of a fragmented system.

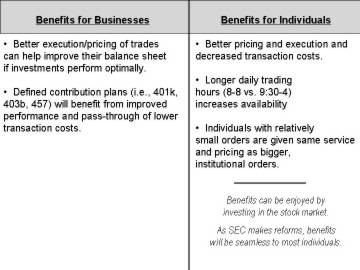

The old rule requires that buy and sell orders for NYSE-listed stocks be routed to the market offering the best price. Buyers want the lowest price, and sellers want the highest price. Shares of companies listed on the NYSE trade on five regional exchanges, the Nasdaq stock market and the quasi-exchanges called Electronic Communications Networks, or ECNs. The Nasdaq has no trade-through rule.

The latest version of the proposed "Regulation National Market System" would expand the trade-through rule to the Nasdaq and all other markets, according to those familiar with the proposal. It also would require these markets to have better electronic links so that investors would be assured of getting the best prices.

Additionally, it would require brokers to electronically disclose all buy and sell orders. Currently, they must reveal only their best buy and sell orders. This provision has aggravated some market participants, because they say it was not included in the original proposal and will be costly to implement.

"It seems like the SEC sneaked this in at the last minute," said Robert McCooey Jr., chief executive officer of the Griswold Co. and an NYSE broker. "If the SEC wanted to do this, it should have disclosed this months ago."

SEC spokesman John Heine would not comment on the issue.

Under current rules, a New York Stock Exchange broker might post his best buy order for, say, 10,000 shares of Cisco Systems stock at $20. The broker might also have several more buy orders at a slightly lower price, say, $19.90, but under the current rules, the broker doesn't have to publish the entire list of bids and offers.

Mr. McCooey said having to reveal his "entire book" could unnecessarily move the stock price against him and his client.

"If you display a large order in a thinly traded stock, you will spook the market," he said. "That will disadvantage our customers."

Mr. McCooey even went so far as to say that if the SEC adopts this portion of the rule, there will be no reason for the exchanges to exist.

"If all the orders are displayed all the time in one system, that's it. There is no ability to compete and no reason for an exchange."

Second, he said, it will be expensive for the exchanges, the ECNs and other market participants to handle the additional data that this part of the rule would require.

"It's one thing to post the best bid and ask prices, but you are talking about an exponential increase in data when you are posting all the orders from all the participants," said an exchange official who asked not to be identified.

Most market experts believe the SEC will extend the trade-through rule to the Nasdaq and other electronic markets. However, it might allow some market participants to opt out of the trade-through rule if they choose.

Fidelity, the giant mutual fund company, has openly criticized the rule because sometimes speed of execution is more important than the best price. Say, Fidelity wants to buy 100,000 shares of a stock, and the best selling price is on the NYSE, where someone is willing to sell 200 shares at $10 a share.

But let's say one of the regional exchanges has a sell order for 100,000 shares at $10.25. Under the current rule, Fidelity's order first must be routed to the NYSE where the 200-share order would be executed before the remainder of the order moves on to the ECN.

No one is sure exactly what the final version of Regulation NMS will look like. But clearly the goal of regulators is to have more disclosure and better pricing.

Kurt Stocker, chairman of the NYSE's Individual Investors Advisory Committee, an advocacy group for individual investors, said he supports any changes that help investors get better pricing when they buy shares. He said he doesn't fully understand all the versions of Regulation NMS, but he thinks the SEC is on the right track.

"I think the SEC's thinking is very clear," he said. "They want investors to get the best price. You just can't take that away from small investors."