Arca's Allure

In the beginning there was ArcaEx. A digital stock exchange that fosters a fair and competitive marketplace for equities and derivatives to be traded. NYSE ArcaNews has plenty of posts from a couple of years ago describing the threat that ArcaEx created for traditional players with open outcry models -- namely the NYSE.

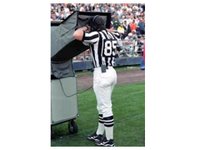

Traders Magazine has an interesting piece that describes how Specialists are warming up to ArcaEx. (read it here) This is significant as players like LAB migrate to the emerging stock market model. One where lead market makers serve the role of Specialists. It's a transformation that is reminisent of how instant replay is used in the NFL. It hasn't replaced referees, but it has improved the fairness, the competitiveness, and overall quality of the game. As a result of the technological improvement of instant replay in the NFL, there were new rules introduced (how many challenges teams can make per half).

Another example of an application of how technology has enhanced an age-old business is ATMs in the banking industry. Among other things, ATMs are open 24 hours/day (have extended hours), are incredibly efficient, and reduce input error dramatically. In fact, initially there was thought that ATMs could take the place of tellers. This idea is similiar to the notion that an electronic system could replace a Specialist. However, what seems most likely is that like NFL referees, Specialists will see their role change -- not be replaced.

In addition to adding value for companies that list on NYSE Arca, ArcaEx adds value for traders, and for lead market makers (including Specialists that emerge as lead market makers). As the Euronext deal becomes solidified, it's exciting to think about other applications of the Arca engine in an expanded universe of equities and derivatives.

(I have been incredibly busy lately so I apologize for the lack of posts recently.)